The global semiconductor market Q4 has a bright score!

According to WSTS data, the global semiconductor market increased by 8.4%in the fourth quarter of 2023. This 8.4%growth is a month -on -month growth since 9.1%in the second quarter of 2021. It is also the first third quarter to the fourth quarter in the past 20 years!

Storage chip is the main driving force of Q4

This strong growth is mainly driven by memory. The memory company reported the growth of health revenue in the fourth quarter of 2023 compared to the third quarter.

Calculated in the US dollar, Samsung's storage business increased by 49%, SK Hemori increased by 24.1%, and Micron Technology increased by 17.9%. The weighted average revenue growth rate calculated by the three companies is 33%. The weighted average revenue growth rate of the largest non -memory company in the fourth quarter of the fourth quarter of 2023 was 4%.

The biggest growth of non -memory companies was MediaTek Technology, which increased by 17.7%, followed by Qualcomm, an increase of 14.2%, and Nvidia, an increase of 10.4%. The revenue of seven non -memory companies in the fourth quarter of 2023 was declined, of which INFINEON fell 10.2%, Texas instruments fell 10.0%, and ADI fell by 8.0%.

In addition to the memory company, most of the other semiconductor companies' outlook for revenue in the next quarter is mostly negative.

Micron is expected to increase by 12.1%. Samsung and SK Hynix did not provide specific guidance, but both said that the memory demand was still strong. The nine non -memory companies are expected to decline in the first quarter of 2024 ranging from 2.8%of INFINEON to 17.6%of Intel. The expected decline is attributed to seasonality, excess inventory, and weakness of the industrial sector.

In 2024, how will smartphones, PCs, automobiles, and industries affect semiconductor companies?

So in 2024, how will a series of applications in the semiconductor market develop?

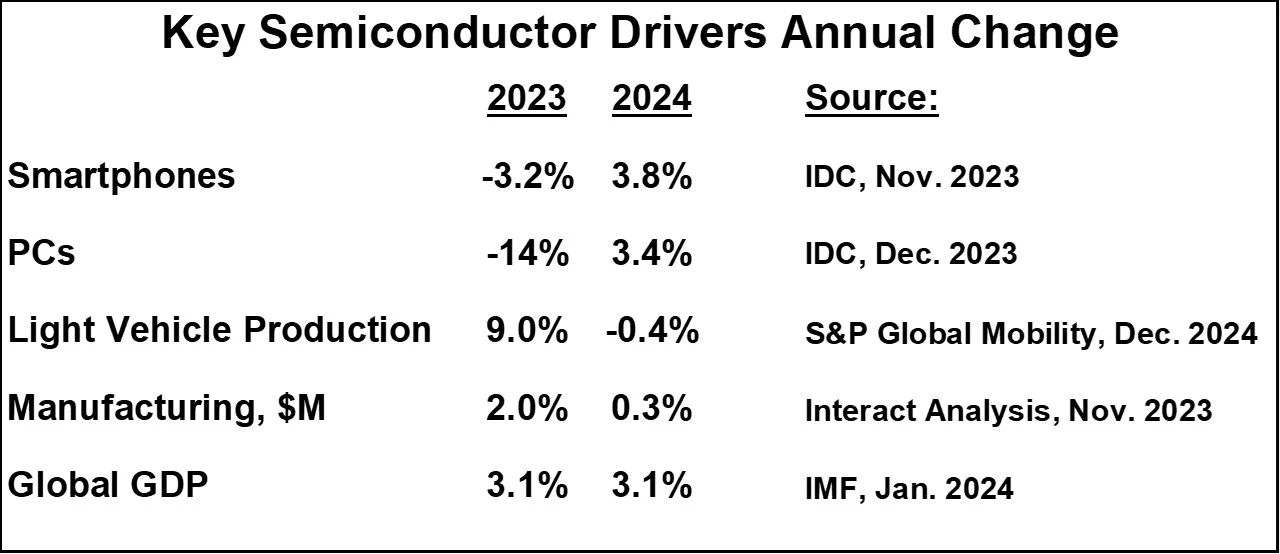

Smart mobile phone shipments fell 3.2%in 2023, but IDC expects that they will rebound in 2024, an increase of 3.8%. Smart mobile phones have promoted the income growth of memory companies, Qualcomm and MediaTek.

Personal computer shipments dropped sharply by 14%in 2023. IDC predicts that personal computers will increase by 3.4%in 2024. The rebound of a personal computer will benefit the memory company and processor company (Intel, Nvidia and AMD).

The automotive and industrial market has become the main revenue driving factor for some companies because other terminal markets are weak. However, 2024 seems to be the end of automobile production growth.

According to S & P global mobility predictions, the production of young vehicles in 2024 will decrease by 0.4%, and a strong 9%growth is achieved in 2023. S & P said that vehicle production and inventory supplements have met recent demand and even exceed the current customer needs. According to data from Interact Analysis, global manufacturing (industrial production) is expected to slow from 2.0%in 2023 to 0.3%in 2024. This shows that the demand for the industrial sector is slow. The deceleration of the automotive and industrial sector mainly affects the semiconductor, Texas Instruments, INFINEON Technology, NXP Semiconductor, ADI and Ruisa Electronics.

The growth of the semiconductor market in 2024 will be driven by memory.

WSTS predicts that the memory will increase by 44.8%, and the non -memory will increase by 6.5%, which will increase the total market by 13.1%in 2024. Gartner assumes that the memory increases by 66%in its prediction, and the total market increases by 16.8%. The memory will be pushed by the recovery of the personal computer and smartphone market. These two areas will also help the non -memory market, but in 2024, the driver's factors in other non -memory markets such as automobiles and industries will be weak.

In this context, what is the prospect of the overall semiconductor market in 2024? Most predictors are expected to have a strong growth, and IDC's highest prediction is "more than 20%". Objective Analysis predicts that it is "less than 5%" because they believe that memory is not sustainable. The latest prediction of semiconductor intelligence showed an increase of 18%. Other forecast range is between 10.5%and 17%.